【2020 Solutions】 Driving AI with Chips, Fansi Data Multiplies Computing Power at Low Cost

A tiny chip capable of driving AI algorithm speeds by nearly a hundredfold, Fansi Data's team is dedicated to software and hardware integration, providing industries including finance, smart healthcare, and smart manufacturing with a cost-effective, high-efficiency way of introducing AI and rapidly undergoing digital transformation.

In recent years, artificial intelligence has been highly prominent; however, practical applications have been limited by high costs. The enhancement of 'computing power' is crucial for breaking through the bottlenecks in AI applications. Fansi Data's customized chip design and solutions can increase processing performance and effectively reduce costs, making AI applications in finance, healthcare, and manufacturing easy and feasible.

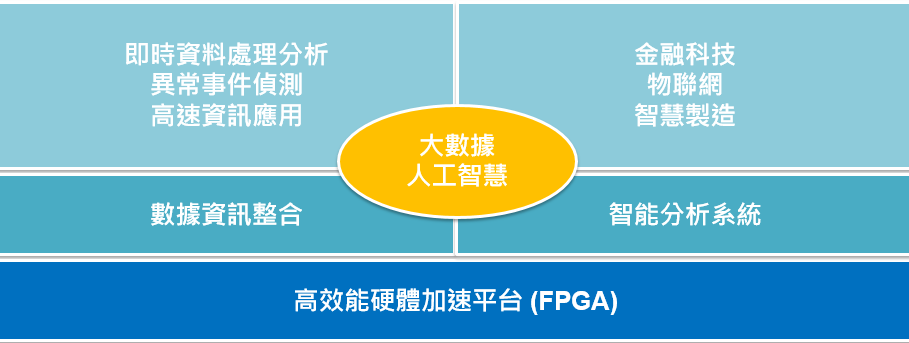

The company's core service is the high-performance hardware acceleration platform (FPGA)

Fansi Data was founded in October 2018 by a founding team from National Tsing Hua University, National Chiao Tung University, and National Taipei University. The company currently has 11 employees, including the chip design director Liu Wenkai from the IC design company Huirong Technology, who leads a 5-person IC design team. They spent over a year developing the high-performance hardware acceleration platform (FPGA), which became the company's core service.

▲Fansi Data integrates software and hardware to develop a high-performance hardware acceleration platform (FPGA)

'To bring AI to practical implementation, the challenges are cost and real processing situations. Purchasing a standard set of NIDIA GPUs is expensive. If we can adjust the hardware through customization, producing a setup tailored for use, the costs can be significantly reduced.' Said Liao Yanchin, General Manager of Fansi Data, who additionally pointed out that most AI startups currently only have software engineers and lack hardware engineers. Fansi Data excels in data handling and software/hardware integration, has an excellent team, and can efficiently solve data issues while developing software/hardware solutions tailored to customer needs.

Financial markets are notoriously fickle, as evidenced by the recent COVID-19 pandemic, which triggered a global stock market crash and was reinforced by program trading, leading to the unprecedented implementation of four trading halts in U.S. stock exchanges within a decade. This has significantly raised investors' risk awareness.

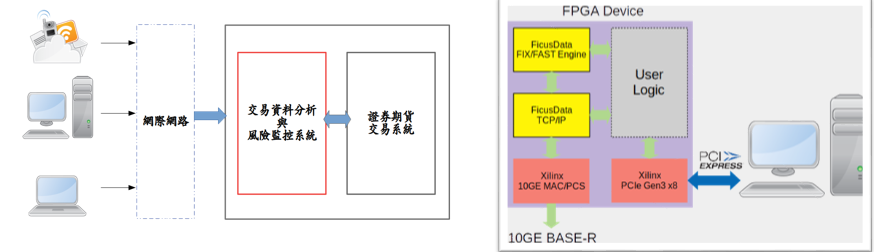

Zheng Zongyi, co-founder of Fansi Data, experienced in financial trading, points out that in financial markets such as stocks, futures, and warrants, 'speed' is often the key to victory. Typically, the traditional stock trading process involves financial trading data flowing from the network to the mainframe, processed through combination software, measured in milliseconds (ms, 10^-3 seconds), with an average transaction completed in 20 ms. System transaction processing speed, however, is at the nanosecond level (ns, 10^-9 seconds), and through the high-performance hardware acceleration platform (FPGA), each financial matching transaction can be completed in microseconds, a significant difference that can lead to billions in trading gains or losses, and is a major competitive edge for proprietary traders.

Financial services in the domain of securities firms' proprietary sections, new types of financial product trading departments, and high-frequency traders (or major retail traders). In the securities market, market volatility is the result of a tremendous amount of data. If the system operates at nanosecond speed, allowing you to see transaction information instantaneously, ahead by 0.1 seconds, you can make trading decisions before others even see the market data.

Service areas focus on financial technology and smart manufacturing

The risk control systems of bank credit cards can also utilize AI integration acceleration, similar to regulatory technology domains. Establishing an AI model can effectively identify risky credit card transactions and provide responses in a very short time, enhancing the security and smoothness of online transactions.

In the AI credit card risk control system, AI acceleration is also used through software integration. Transactions are prevalent, and fraud is common, similar to regulatory technology domains. By establishing an AI model, risky credit card transactions can be effectively identified, and responses given in a very short time, enhancing the security and smoothness of online transactions. This includes financial transactions and credit card risk identification, all through chip-based transaction data analysis and risk management system direct acceleration calculations.

▲Financial transaction information acceleration solution

Currently, many financial companies have their own IT departments, including data scientists, big data analysts, and AI algorithm engineers. What is Fansi Data's advantage in the financial sector? Zheng Zongyi points out that the IT departments in the financial industry are more 'users' of IT, not 'developers' of IT. Moreover, understanding IC design involves high costs, and the financial industry does not need to maintain their IC design team. The specialization is very clear, as Fansi simply develops models for the financial industry to adopt.

Considering personal privacy and data security, financial data is sensitive and often not easily accessible. Fansi Data, by joining the financial technology innovation park (FinTechSpace) and with the assistance of the Institute for Information Industry, applies for the real-time transaction data and corporate annual financial statements, historical trading data provided by the digital sandbox, using it to group data, analyze, model, backtest, and propose AI risk warnings and other solutions for abnormal transactions and risk management.

Besides financial technology, Fansi Data also focuses on AI applications in smart manufacturing, such as developing smart image meter reading through image recognition methods, which can help businesses reduce equipment replacement costs and achieve higher accuracy.

In the process of customized chip design, data analysis, and software/hardware integration, Fansi Data encounters difficulties in data and talent acquisition. At this stage, through interfacing with the digital sandbox and utilizing resources provided by the financial technology innovation park, AI models are built; regarding talent, a lean core team is established, continuously accumulating experience and building a robust entrepreneurial culture to face the ever-growing market demands.

▲From left to right: Co-founder Zheng Zongyi, General Manager Liao Yanchin, and Chip Design Director Liu Wenkai

「Translated content is generated by ChatGPT and is for reference only. Translation date:2024-05-19」