【2020 Solutions】 Robot financial management helps investors balance risks and profits

In the era of "if you don't manage your money, money will not care about you", how to avoid the risks of the investment market and grasp investment returns has become the biggest hope of investors. In order to overcome the human weaknesses of greed and fear, financial management robots developed through AI algorithms can help investors avoid disasters and enjoy fruitful profits in the treacherous and ever-changing financial market.

On March 17, 2020, affected by the global spread of the new coronavirus pneumonia (COVID-19, also known as Wuhan pneumonia), the U.S. stock market continued to plummet after opening, triggering the third circuit breaker in the U.S. stock market, which was also the fourth in history. After the circuit breaker, investors in the securities market were in distress and could not even escape for their lives. Before that, the financial management robot had suggested adjusting the proportion of stocks and bonds, reducing the proportion of high-risk stocks, increasing the proportion of relatively safe bonds, and adding high risk aversion Gold and other combinations enable investors to effectively reduce investment risks and losses.

Robotic financial management has two service models: B2B and B2C

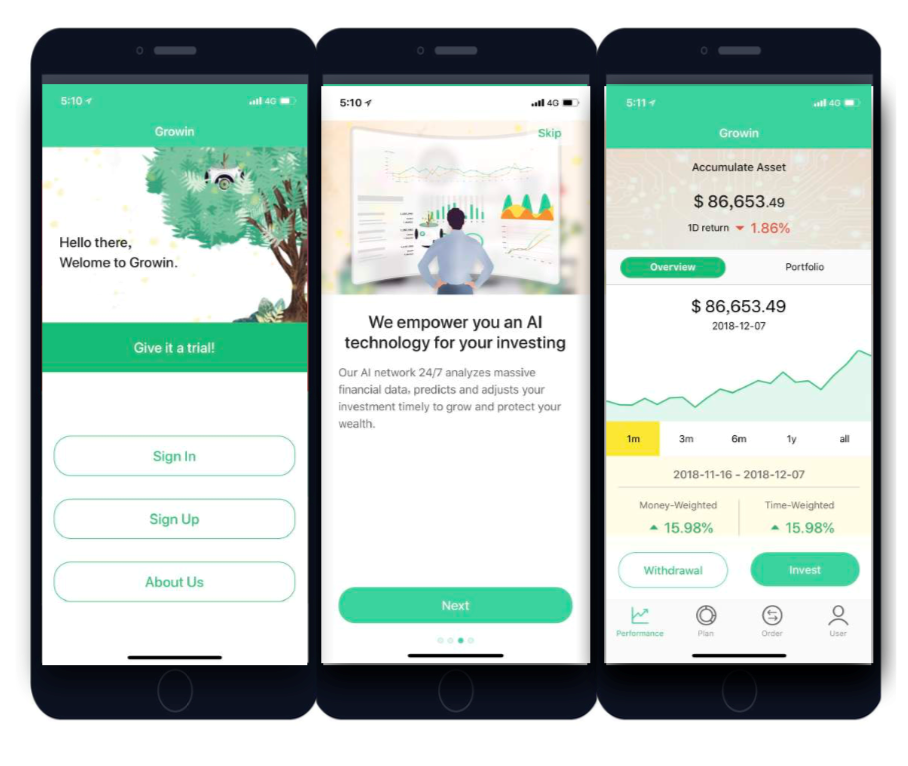

The robot financial management service provided by Leading Information Technology Company provides investors with a stable financial management tool. Peng Hansheng, co-founder and CEO of Leading Information Technology, said that Leading Information Technology currently provides two service models. The first is the Taiwan B2B model, which is to cooperate with domestic financial institutions to provide robot financial algorithm engines, Artificial intelligence market prediction engine, jointly launch robot financial management services; the other is an American B2C model, aiming to serve Chinese American customers, self-developed intelligent financial management APP Growin, using AI and quantitative models to provide customized investment and financial management in ETFs and individual stocks. Serve.

Among them, due to restrictions on regulations, the B2B financial management robot launched by Leading in Taiwan is cooperating with the domestic financial industry, including banks, insurance, etc. Currently Leading's partners include an investment advisory and credit company, and a life insurance company. The company and two banks provide customer financial management robots as a trading tool that consumers can rely on.

In addition, Taiwan's leader in the information service industry - Jingcheng Information provides diversified financial information services to financial institutions. Liding also provides investors with investment portfolio recommendations for smart financial management by connecting APIs to the Jingcheng Information system.

▲Smart financial management APP Growin uses AI and quantitative models to provide customized investment and financial services in ETFs and individual stocks

The financial regulations in the United States are relatively mature, allowing companies to set up online investment advisory companies. Liding connects with the U.S. brokerage system through APIs, and the partner is Interactive Brokers, the largest and No. 1 company in the United States. Broker), providing direct consumer services. Interactive Brokers customers can place orders directly through the APP and enjoy the services of the financial management robot. The iOS version is currently available for download. The robot financial management platform charges a management fee of 0.5%-1% of the investment amount every year. There are 10 investment portfolios for consumers to choose from. Stocks with high investment returns have higher management fees. If you choose relatively stable ETFs, the fees will be Less expensive.

The services of Liding Financial Management Robot are mainly focused on medium and long-term investment. Taking the United States as an example, the investment targets include 5,000 stocks and 2,000 ETFs in the U.S. market. Among them, the average investment return rate based on different risk investment portfolios is 4.5%. -18% or so, and ETF is between 4.5% and 9%. Introducing AI algorithms into investment and financial management can not only significantly reduce the impact of human emotions, but also enable disciplined execution of every investment decision, more effective prediction of the market, and immediate response to its trends.

▲Robotic financial management targets retired people and focuses on medium and long-term investment

Take the global stock market crash triggered by the impact of the new coronavirus as an example. The original investment portfolio of the financial management robot had a stock and bond ratio of 7 to 3 respectively. Shortly after the global stock market crash, it automatically reversed and adjusted to 3 to 7, that is, to increase the bond ratio. Proportion, reduce the proportion of stocks to avoid high investment risks. Peng Hansheng said that the financial management robot uses AI technology models to gather 18 important global market indicators and economic trend forecasts for the next 1-3 months. It can provide reversal suggestions when the market is about to fall sharply and avoid high investment risks. Therefore, in The losses were relatively minor amid a sharp decline in global stock markets. However, relatively speaking, when global stock markets rose sharply in April, the growth rate of financial management robots was relatively small, which is suitable for steady financial investors who pursue long-term performance.

Peng Hansheng said that investor financial management through AI algorithms can overcome the investment mistakes that ordinary investors are easily affected by emotions, news or irrational selling. At the same time, in the form of a basket investment portfolio, It can also effectively diversify risks and reduce investment losses.

Integrated learning concepts can achieve dynamic asset allocation effects

return on investment. The so-called "ensemble learning" solves a single prediction problem by building a combination of several models. Its working principle is to build multiple classifiers/models on the data set, each independently learn and make predictions, and these predictions are finally combined into a single prediction. The predictions are therefore better than those made by any single classifier.In addition, using an "unsupervised" training and learning method, also known as "Hierarchical Clustering", the system will automatically classify the investment targets within the target range every month, allowing the machine to learn Financial report information, value investment, and then improve operational performance.

The choice of robot financial management as an entrepreneurial theme is mainly related to Peng Hansheng's financial engineering background. He graduated from the Department of Finance at Tsinghua University and later went to Columbia University to study financial mathematics. After graduation, he entered Wall Street to engage in quantitative trading 2-3 year time. Three years ago, after witnessing the sudden ups and downs of the stock market and investors' irrational pursuit of highs and lows, resulting in investment failures, Peng Hansheng decided to contribute what he had learned to Taiwanese society and founded Liding Information Technology Company, specializing in robot financial services. It is hoped that through the new smart financial management method driven by AI, it can help investors avoid bad luck and manage their finances steadily.

The most difficult thing about promoting AI financial management is that according to statistics, when financial management robots make investment portfolio recommendations, up to 40% of investors do not follow them, unable to overcome human weaknesses, and the final result is a losing position. getting bigger. In addition, in the B2B robot financial management market, the business logic of banks and insurance industries is different from that of financial management robots. For example, banks specialize in wealth management, and high-end customers usually prefer direct service from financial specialists and do not like to interact with machines. Therefore, promotion in the banking industry is difficult. In the future, bank financial professionals or securities traders will be targeted, making the financial management robot an investment advice auxiliary tool for financial professionals and stock traders.

▲Peng Hansheng, co-founder and CEO of Liding Information Technology

「Translated content is generated by ChatGPT and is for reference only. Translation date:2024-05-19」